How CoreWeave Stock Became a $1.7 Billion Win for Nvidia

As the tech landscape continues to evolve, few companies have captured the spotlight like CoreWeave, especially following a strong performance that has caught the attention of investors and analysts alike. The surge in interest is largely attributed to Nvidia’s strategic investments in the company, which have significantly enhanced the market perception and valuation of CoreWeave. As of March, Nvidia owned an impressive $900 million in CoreWeave stock, a staggering figure that underlines the collaborative advantages arising from their partnership.

The Rise of CoreWeave

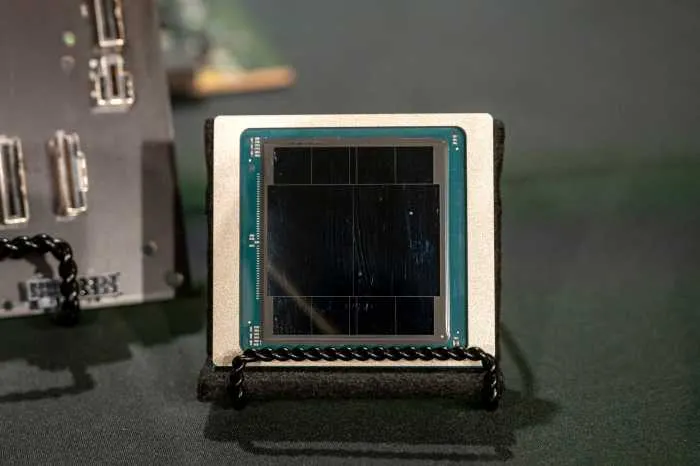

CoreWeave has established itself as a prominent player in the cloud computing sector, known particularly for its GPU-accelerated services. The company’s focus has been on providing scalable infrastructure for various computational tasks, notably in deep learning, machine learning, and high-performance computing applications. In an era where data is touted as the new oil, CoreWeave’s services have become increasingly essential for businesses that rely heavily on processing vast amounts of information.

Nvidia’s Strategic Investment

Nvidia, the leading GPU manufacturer and a giant in the tech industry, recognized the potential of CoreWeave well before the wave of excitement washed over the stock market. With Nvidia investing $900 million in CoreWeave, the connection between these two companies suggests a promising future. Nvidia’s backing not only solidifies CoreWeave’s credibility but also enhances its growth prospects, providing it with an invaluable lifeline during a competitive time in the tech sector.

The Impact of the Investment on CoreWeave’s Valuation

The immediate aftermath of Nvidia’s investment saw CoreWeave’s valuation soar to approximately $1.7 billion. Investors, buoyed by Nvidia’s endorsement, are starting to view CoreWeave as a formidable contender in the cloud computing industry, especially in sectors that require advanced computational capabilities.

Market Response to CoreWeave’s Growth

Following the news of Nvidia’s stake, CoreWeave’s stock displayed remarkable resilience, capturing significant attention from the investment community. Analysts have suggested that CoreWeave’s unique positioning allows it to tap into a burgeoning market, primarily driven by the acceleration in AI workloads, particularly those reliant on Nvidia’s cutting-edge technologies. The synergy that exists between CoreWeave’s service offerings and Nvidia’s hardware capabilities presents an attractive investment hypothesis for prospective investors.

CoreWeave Post Q1 Earnings

The excitement is palpable as investors eagerly await CoreWeave’s Q1 earnings report. Such earnings are crucial for stakeholders as they gauge the company’s performance and sustainability in a rapidly changing market. Patrick Kelly, CoreWeave’s CEO, has hinted at promising growth metrics during this period, but skepticism also lingers regarding potential volatility should the results fall short of market expectations.

Should You Stay Invested or Sell? Exploring the Options

With the upcoming earnings report on the horizon, investors are left to ponder their next steps—should they remain invested in CoreWeave or consider pulling back?

Reasons to Stay Invested

- Continued Growth Potential: CoreWeave’s fundamental business model aligns closely with the increasing demand for sophisticated cloud computing solutions.

- Strong Backing from Nvidia: Nvidia’s strategic involvement presents a protective barrier against many risks faced by independent ventures in tech.

- Market Trend: As the technology sector increasingly embraces AI, CoreWeave stands to benefit significantly from scalability and higher demand for GPU resources.

Reasons to Consider Selling

- Performance Relativity: If market performance does not meet high expectations, stock volatility could lead to significant losses.

- Overvaluation Concerns: The valuation of $1.7 billion, while impressive, may prompt reevaluation by insiders and analysts if earnings dampen sentiment.

- Turbulent Market Conditions: The broader economic environment presents risks such as potential regulations or shifts in technology investment strategies.

Conclusion

As CoreWeave prepares to unveil its Q1 earnings, the crossroads it faces encapsulates the broader dichotomy of risk versus reward that permeates the tech investment landscape. Nvidia’s bet on CoreWeave has undoubtedly boosted confidence in its market prospects; however, the uncertainty surrounding earnings adds an element of tension.

Investors must consider personal risk tolerance and market dynamics carefully as they contemplate their next moves regarding CoreWeave stock. Whether to stay invested or to capitalize on gains by selling largely depends on one’s assessment of CoreWeave’s operational performance and future potential amid an evolving tech ecosystem.

Final Thoughts

Investing in CoreWeave is not just about capital gains; it represents a chance to support a game-changing entity in the technology domain. As the dust settles post-earnings announcement, stakeholders must remain vigilant, weighing economic forecasts, competitive actions, and CoreWeave’s actual performance against the backdrop of Nvidia’s growing influence in the sector.