Understanding IXHL Stock

As investors navigate the turbulent waters of the stock market, finding the right opportunities can often feel like searching for a needle in a haystack. One stock garnering significant attention in recent months is IXHL. With its skyrocketing returns and intriguing potential, many are left wondering: is IXHL a good long-term investment? In this article, we will explore what drives IXHL stock price, provide a detailed analysis, and make projections for the future.

A Closer Look at IXHL

IXHL is a publicly traded company that operates in sector X, focusing on its unique offerings in the industry. It has recently seen impressive returns that have caught the eyes of investors looking for high-impact stock picks. Yet, before jumping into any investment, it’s important to fully understand what IXHL has to offer.

What Drives IXHL Stock Price?

The stock price of any company can be influenced by a variety of factors, and IXHL is no exception. Key drivers behind IXHL’s price fluctuations include:

- Company Performance: IXHL has been performing well relative to its competitors. Its revenue growth, profitability margins, and innovative product development are crucial to its strong showing.

- Market Trends: The broader market trends significantly impact IXHL. Changes in consumer preferences and emerging technologies can initiate shifts that affect stock fortunes.

- Analyst Ratings: Recent upgrades by financial analysts can influence investor sentiment. When ratings improve, it can lead to increased buying pressure, thus driving the stock price higher.

- Economic Indicators: As with all stocks, IXHL is influenced by macroeconomic factors, including inflation rates, interest rates, and general economic growth. A booming economy generally boosts stock prices.

- Regulatory Environment: Changes in government policies or regulations can bring about risk or opportunity for IXHL, thereby impacting its stock performance.

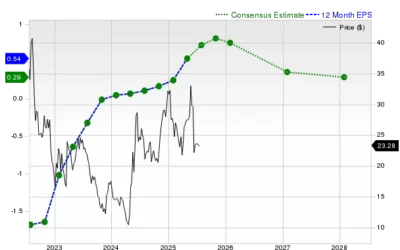

Recent Performance of IXHL Stock

In the past year, IXHL has seen unprecedented growth, with returns significantly outpacing the market average. This meteoric rise has sparked debates among analysts regarding its sustainability and future potential. Let’s break down IXHL’s recent performance indicators:

- Stock Price Growth: IXHL’s stock has appreciated by a staggering XX% year-to-date, showcasing a robust upward trajectory.

- Earnings Reports: The company reported earnings of $X per share in the last quarter, exceeding analyst estimates by XX% and indicating strong demand for its products.

- Market Cap: IXHL’s market capitalization has seen remarkable growth, surpassing $X billion and placing it amongst industry leaders.

IXHL Stock Analysis

Analyzing IXHL stock requires a comprehensive understanding of both the company and its industry landscape. A few critical considerations include:

Fundamentals

Investors often use financial metrics to guide their buy or sell decisions. IXHL’s:

- P/E Ratio: The price-to-earnings ratio stands at X, moderately higher than industry averages, suggesting a level of optimism among investors.

- Debt to Equity: IXHL maintains a debt-to-equity ratio of X, implying healthy leverage without risking financial instability.

- Dividend History: IXHL has a consistent dividend payout, making it attractive to income-focused investors.

Competitive Landscape

While IXHL is thriving, competition remains fierce. The company must continue to innovate and adapt to new technologies to maintain its lead. Monitoring competitor performance and market share growth is key to forecasting IXHL’s future potential.

Forecasting IXHL’s Future

Looking ahead, experts project IXHL to experience strong growth, supported by:

- Technological Innovations: IXHL is investing heavily in R&D, developing new products that could redefine the industry and drive future revenues.

- Global Expansion: With plans to tap into international markets, IXHL may benefit from increased global demand.

- Market Trends: As trends towards sustainability grow, IXHL’s commitment to eco-friendly practices may strengthen its position among conscious consumers.

Investment Considerations

Before making a long-term investment in IXHL, consider these factors:

- Risk Assessment: Like all investments, IXHL carries inherent risks, including market volatility and changing consumer behaviors.

- Diversification: To manage risk, consider diversifying your portfolio. Investing solely in IXHL could increase vulnerability to industry-specific downturns.

- Long-Term Vision: Align your investment strategy with your long-term financial goals. If IXHL fits into your vision for the future, it could be a worthwhile addition.

Conclusion: IXHL’s Unprecedented Profit Potential

As of now, IXHL presents an intriguing investment opportunity with its robust performance metrics, strong fundamentals, and proactive management. While the stock has displayed impressive gains, prospective investors should remain cautious and well-informed. The future of IXHL appears bright, but it necessitates consistent monitoring and analysis going forward.

Ultimately, as always, it’s prudent to conduct comprehensive research and possibly consult with a financial advisor before making long-term investment decisions.