Introduction

AT&T Inc. (NYSE:T) has recently been in the spotlight due to a series of negative pressures affecting its stock price. Investors are closely watching the future forecasts of this telecommunications giant, especially as data from mid-July 2025 indicates that the stock is currently trapped in a hesitant position. Multiple factors contribute to this scenario, including recent sell-offs, market sentiment, and broader economic conditions. In this article, we will analyze these factors, offer insights into future forecasts, and explore the implications of Windle Wealth LLC’s recent sell-off of 39,029 shares.

The Current State of AT&T’s Stock

As of July 21, 2025, AT&T’s stock price has shown signs of hesitation amid fluctuating market sentiments. Stock price is often influenced not just by company performance, but also by investor expectations and market trends. In recent weeks, AT&T has experienced significant downtrends, with its stock price reflecting investor concerns over debts, subscriber growth, and competition in a rapidly evolving industry.

Financial analysts note that AT&T has indeed been trapped in a somewhat precarious spot. Following a detailed review of the company’s quarterly performance reports, it appears that while revenues are stable, profits are being pressured by increased operational costs and declining revenues in traditional segments.

Historical Perspective: A Look Back at AT&T’s Performance

To better understand the current issues at hand, it’s valuable to examine AT&T’s past performance. The company has undergone significant shifts over the last few years. The acquisition of Time Warner in 2018 was intended to diversify offerings and reduce dependency on traditional telecommunications. However, this strategy has met resistance amid changing consumer behavior and rising competition.

From peaks in stock valuation, AT&T has had to grapple with delivering returns to shareholders while satisfying broader strategic mandates. In 2022, AT&T announced it would focus on its core telecommunications business, selling off several non-core assets. These decisions were insights into the broader challenges the company has faced and continue to underscore the organizational struggles AT&T faces ahead in fully realizing value from past investments.

Current Challenges Amid Broader Industry Trends

The telecom industry is continuously evolving with the advent of 5G technology and increasing competition from new market entrants and existing giants like Verizon and T-Mobile. AT&T’s attempts to further its 5G rollouts and expand its broadband service have been met with mixed results and often delayed by regulatory challenges.

Besides external pressures, internal factors such as operational efficiencies and debt management have put further strain on the stock. AT&T has one of the highest debt levels in the industry, which has led to increased scrutiny from bond rating agencies and investors alike.

Windle Wealth LLC’s Recent Sell-Off

Recent reports reveal that Windle Wealth LLC sold 39,029 shares of AT&T, which adds an interesting layer of complexity to the ongoing story surrounding the telecommunications giant. Sell-offs from institutional investors can often signal lack of confidence in a stock, leading to wider panic amongst retail investors.

While institutional selling does not always equate to poor forecasts, the timing of this particular sell-off, alongside the stock’s hesitant movement, raises questions. What caused Windle Wealth to believe that a reduction in their holdings of AT&T is necessary? Market analysts speculate several possibilities, including concerns over AT&T’s future growth in a highly competitive environment.

Market Sentiment and Future Forecasts

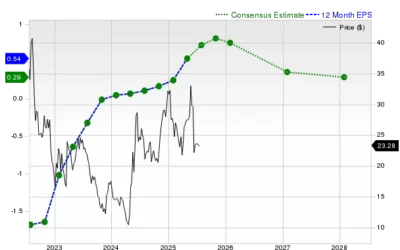

While AT&T’s current market position appears challenging, numerous voices in the investor community are calling for scrutiny rather than outright pessimism. Market sentiment plays a crucial role in stock valuation, and such views can shift rapidly. Forecasts for AT&T suggest that if the company can successfully navigate its debt levels, enhance its operational efficiencies, and tap into new revenue streams, a potential upswing might be where we are headed.

Forecasts for AT&T’s stock in the next few months have shown a split among analyst opinions. Some analysts maintain an optimistic outlook, positing that the company’s strategic focus on 5G deployment will eventually translate to revenue growth. Others remain cautious, warning of external market pressures and increased competition that could impede AT&T’s ability to rebound.

The Broader Economic Context

It’s important to contextualize AT&T’s challenges within the broader economic environment. The post-pandemic recovery has been uneven, with inflation and supply chain issues affecting multiple sectors, including communications. Federal Reserve monetary policy continues to create uncertainty in the markets. Given AT&T’s significant debt burden, rising interest rates could pose additional challenges for the company.

Conclusion

In conclusion, AT&T Inc. is currently navigating a complex terrain marked by significant challenges, upcoming forecasts, and shifting market sentiments. The stock is presently trapped in a hesitant position, reflecting broader concerns linked to operational performance and market dynamics. The sell-off by institutional investors like Windle Wealth LLC serves as a reminder of the palpable uncertainty in the stock. While future projections indicate potential opportunities for growth, investors and analysts must keep a keen eye on both the company’s maneuvering and external economic indicators. Only time will tell how AT&T responds to these pressures, but one thing is clear: stakeholders must remain vigilant as this saga continues to unfold.