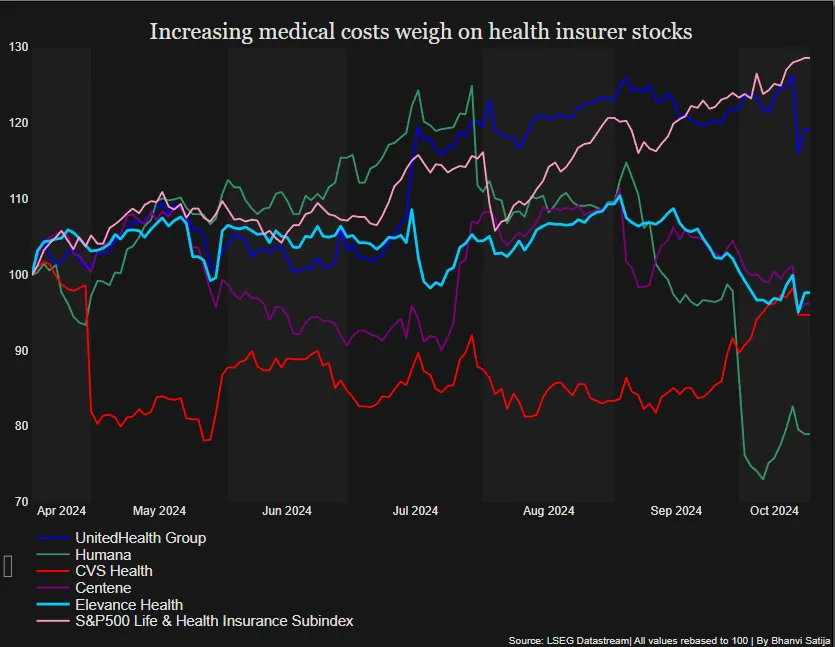

Overview: The Landscape for Elevance Health (ELV)

In the ever-changing landscape of health insurance and healthcare service providers, Elevance Health, previously known as Anthem, has found itself at a pivotal juncture. As the company prepares to report its earnings tomorrow, its stock (ticker: ELV) has faced noteworthy volatility—particularly following the release of its second-quarter results. The outlook from Elevance Health for the remainder of the year has led to a decline in share value, mirroring broader worries concerning rising operational costs and sustained pressures on profit margins.

A Deep Dive into Q2 Results

Elevance Health’s Q2 results were met with mixed reactions from analysts and investors alike. The company posted adjusted earnings that fell short of Wall Street forecasts, despite reporting strong membership growth in its commercial and government segments. The increase in membership is a positive indicator for the company’s long-term growth prospects, yet it has been overshadowed by rising costs in various sectors, including medical services, salaries, and ongoing inflationary pressures.

Executives at Elevance noted that while the company experienced growth, their operational costs have risen more than anticipated. Medical expenses, particularly, have escalated due to an increase in utilization as more patients sought care post-COVID-19 lockdowns.

Revised Annual Forecast

Following the announcement of its Q2 results, Elevance shocked the market by revising its annual earnings forecast downward. The adjusted earnings per share were expected to be lower than previously estimated by analysts. This revision raised concerns about the overall profitability of the company in the coming quarters.

Investors typically take such adjustments seriously, as they indicate potential trouble within the company’s operations or unexpected industry shifts. Elevance Health’s management pointed out that while they remain focused on improving operational efficiency, they cannot ignore the mounting pressures that affect the bottom line.

Industry-Wide Challenges Influencing Costs

The health insurance industry is currently facing several overarching challenges. Rising healthcare costs have been a key factor that has impacted many players in the market. Some of the notable reasons for high costs include:

- Increased Utilization of Services: Post-pandemic, the surge in patients seeking care has strained resources. More patients are utilizing healthcare services, pushing costs higher.

- Supply Chain Issues: Disruptions caused by the COVID-19 pandemic have led to rising costs in pharmaceuticals and medical supplies.

- Labor Shortages: With a shortage of medical professionals, companies are facing higher labor costs, which directly affects their operational expenses.

- Inflationary Pressures: Inflation is affecting nearly all sectors, including healthcare, leading to increased costs across the board.

Market Reaction to Q2 Results

Elevance Health’s shares experienced a noticeable decline following the release of the Q2 results and the grim revision of their annual forecast. The stock price fell by approximately 7% in after-hours trading, signaling bearish sentiments among investors.

This reaction was not unexpected. When a company such as Elevance adjusts its guidance after reporting results, investors often take it as a sign to reevaluate their positions. Analysts also downgraded their ratings on the stock, citing the changing landscape and increased operational risks moving forward.

What to Expect in Tomorrow’s Earnings Report

As investors gear up for Elevance Health’s earnings report tomorrow, many will be watching closely for signs of improvement or potential recovery. Given the recent downward revisions, analysts will be particularly attentive to:

- Revenue Growth: Is Elevance’s revenue growth consistent with its projections, especially given their increased membership numbers?

- Cost Management Efforts: What measures is the company implementing to manage rising costs?

- Future Guidance: Will Elevance reaffirm its commitment to growth or outline further adjustments based on a changing cost structure?

- Market Conditions: Any commentary on the state of the healthcare market, including anticipated regulatory changes, medical costs, and competition.

Investors’ Sentiment Going Forward

Despite the current challenges, some analysts remain bullish on the long-term prospects for Elevance Health. They argue that the company is well-positioned to benefit from demographic trends leading to increased healthcare spend and a shift toward value-based care models. However, cautious investors may look for evidence of stabilizing costs and operational efficiencies before increasing their investment in ELV.

Furthermore, industry experts suggest that Elevance Health’s diversified portfolio and investment in technology could yield benefits in the long term. The company’s focus on digital health and integrated care models represents a strategic shift that could help them overcome some of the current pressures.

Conclusion

As Elevance Health approaches its earnings report, it finds itself in a challenging position amidst rising costs and a newly revised outlook. Investors are understandably anxious given the potential impacts of operational issues and market conditions. Keeping a close eye on tomorrow’s report will be crucial for anyone holding ELV stock or considering an entry point at these lower valuations. One thing is certain—the healthcare sector continues to evolve, and companies like Elevance must adapt to navigate these turbulent waters successfully.