GME: GameStop Corp. Attracting Investor Attention

In the ever-evolving world of the stock market, few stories have been as riveting as that of GameStop Corp. (GME). Once a small player in the video game retail industry, GME has recently captured the fascination of investors, largely due to its meteoric rise and the retail trading frenzy that took the world by storm in early 2021. As we delve deeper into what is currently driving interest in GME, we will also draw comparisons to another noteworthy player in the stock market: Hologic Inc. (HOLX) and explore its performance forecast.

Understanding GameStop’s Current Landscape

GameStop was traditionally known for its brick-and-mortar video game retail stores, which faced significant challenges in the wake of a rapidly shifting consumer landscape towards digital gaming. However, a combination of strategic leadership changes, an evolving business model, and heightened interest from retail investors has placed GameStop back into the spotlight.

In recent months, GME has been emphasizing its transformation into a tech-centric company, focusing on e-commerce. The appointment of a diversified board and potential partnerships with key technology players are aimed at innovating its service offerings beyond retail. This strategic pivot has been crucial for winning over a new generation of investors who are looking for tech-forward growth.

Recent Stock Performance and Investor Sentiment

As of late 2023, GME has seen fluctuating stock prices, but the overall trajectory is one of cautious optimism. Contribution factors are not only the broader retail market trends but also the ongoing influence of Reddit communities like r/WallStreetBets. Retail investors continue to exhibit strong emotional and financial ties to GameStop, often viewing it as a symbol of a fight against traditional hedge fund practices. This creates a unique market environment that traditional trading analyses often overlook.

Competitive Landscape

Competing within the broader video game and entertainment market, GME now faces various forms of competition from both traditional retailers and emerging digital platforms. Companies like Amazon and digital download services have noticeably shifted the playing field. However, GameStop is not merely sitting back; it continues to innovate its inventory systems, improve customer experiences, and explore omnichannel selling strategies.

Why Investors Are Taking Notice

The recent uptick in investor interest can be attributed to a combination of elements:

- Market Volatility: The unpredictable nature of the market gives rise to opportunities for quick gains associated with stocks like GME.

- Retail Investor Influence: A strong community of retail investors propels GME stock fluctuations, making it a point of interest for both retail and institutional investors.

- Speculative Trading: With many new investors engaging in speculative trading, stocks with high short interest like GME tend to attract attention, leading to sharp price movements.

What Lies Ahead for GameStop?

Looking ahead, market analysts remain divided on GameStop’s long-term prospects. Some hold a bullish outlook, positing that if the company successfully adapts to the digital gaming world, it could continue to serve as an investment darling. Others maintain a cautious approach, warning of the frequent volatility and risks intrinsic to meme stocks.

Hologic Inc.: Stock Analysis and Forecast

Meanwhile, another company gaining traction in the stock market is Hologic Inc. (HOLX), a global leader in women’s health and diagnostics. The company’s trajectory, particularly during a time when healthcare visibility has increased due to recent global health events, has investors intrigued.

Understanding Hologic’s Business Model

Hologic primarily focuses on areas such as breast health, diagnostics, and surgical products. With increasing awareness around women’s health issues and the imperative for comprehensive diagnostic solutions, Hologic stands to benefit significantly. The company has also pursued strategic acquisitions to bolster its product offerings in the specific areas of diagnostics and imaging.

Recent Trends and Performance Review

In the most recent quarterly earnings report, Hologic demonstrated robust performance driven by strong demand for its diagnostic tests, especially during public health crises. The company reported an increase in revenue, coupled with strong profit margins.

Performance metrics showing a consistent increase in year-on-year revenues and profits place Hologic favorably among its peers. The demand for women’s health initiatives and advanced diagnostics is projected to sustain the company’s growth momentum.

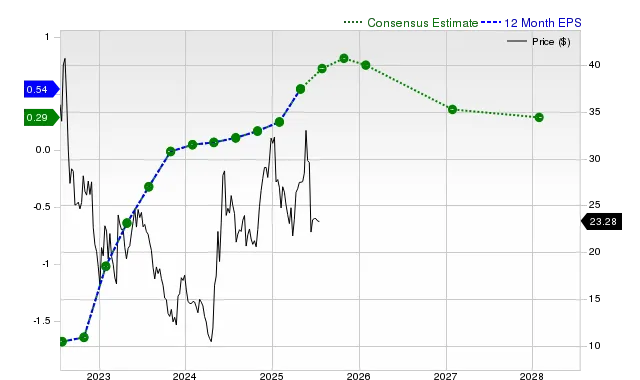

Q3 2025 Earnings Report Expectations

Looking ahead toward Hologic’s Q3 2025 earnings report, investors are keen on the company’s ability to maintain or improve its growth trajectory. Analysts’ forecasts suggest:

- Continued Revenue Growth: Analysts expect Hologic to post continued revenue growth, with emerging markets becoming critical drivers.

- Profit Margins to Stay Strong: With the company’s focus on high-margin products, profit margins are anticipated to remain healthy.

- Potential for Strategic Acquisitions: A push for further acquisitions to bolster their presence in diagnostics may further enhance growth potential.

Overall, sentiment surrounding Hologic is mostly positive, with analysts expressing optimism about the company’s future, especially given the current market dynamics favoring healthcare sectors.

Comparative Outlook: GME vs. Hologic

When comparing GameStop to Hologic, it’s evident that they reside in vastly different sectors, each with unique challenges and opportunities. GME is navigating the competitive video game retail market while simultaneously appealing to a fervent retail trading audience.

Conversely, Hologic benefits from structural healthcare trends that cannot be ignored. The market’s focus is pivoting toward essential healthcare products, making Hologic a rather safe investment option compared to the speculative risk surrounding stocks like GME.

Conclusion

In summary, GameStop Corp. continues to charm investors through its narrative and volatility, while Hologic Inc. offers steadfast growth backed by essential healthcare initiatives. Investors should weigh their risk appetite and assess both companies’ fundamentals before making any investments. Navigating the future will require understanding not just the business strategies employed by each but also the community-driven nature of trading today. Whether one is drawn to the speculative thrill of GME or the growth-oriented approach of Hologic, informed decisions will remain paramount as market conditions continue to evolve.