Kraken Takes the Leap into Tokenized Equities

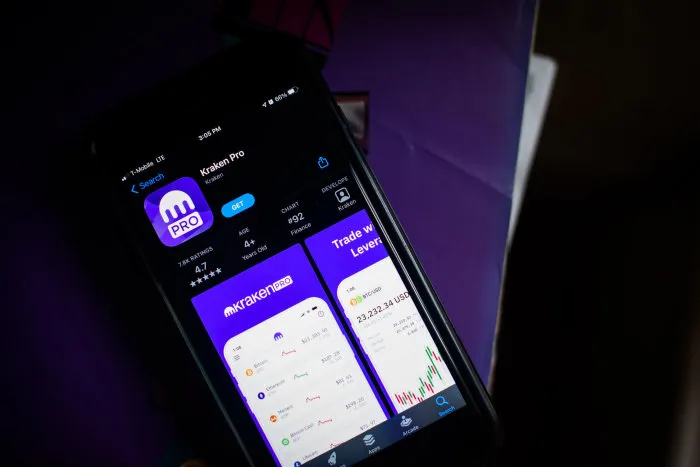

In an unprecedented move, the cryptocurrency exchange Kraken has announced that it will allow trading of digital tokens representing shares from some of the world’s most valuable companies, including Apple, Tesla, and Nvidia. This development promises to reshape the investment landscape, making traditional equities more accessible and tradeable on the blockchain.

What Does This Mean for Investors?

Tokenized equities are essentially digital representations of stocks that are recorded on a blockchain, allowing for fractional ownership and potentially lower transaction costs. By facilitating trades in this manner, Kraken is diving into a new frontier of finance, aptly blending the lines between the world of traditional investing and decentralized finance (DeFi).

A Paradigm Shift for Stock Trading

The launch of tokenized shares is expected to empower investors outside of the United States, enabling them to trade stocks as digital tokens swiftly and efficiently. This initiative signifies Kraken’s ambition to transform how global investing occurs and highlights a growing trend in financial markets where blockchain technology is being utilized to enhance liquidity and democratize access to assets.

The Mechanics Behind Tokenized Equities

So how does this work? When investors trade tokenized equities on Kraken, they’re purchasing digital tokens that represent shares in the chosen company. A single token could represent a fractional share of the stock, allowing investors who may traditionally lack the resources to invest in a high-value company like Tesla the opportunity to own a piece of it. This innovative system breaks down the barriers to entry for many investors and makes it easier to diversify portfolios.

Why Apple, Tesla, and Nvidia?

Apple, Tesla, and Nvidia have been at the forefront of stock market innovation in the past years. Their stocks have shown significant growth and resilience, making them highly desirable among investors. As Kraken aims to attract a global user base, aligning with these well-known companies offers instant credibility and familiarity, urging traditional investors to explore the digital assets space.

Challenges and Considerations

The introduction of tokenized equities is not without its challenges. Regulatory hurdles remain a primary concern for Kraken as the exchange seeks to navigate the complex landscape of global financial regulations. Additionally, ensuring that ownership rights are properly represented in the blockchain environment is crucial to protecting investors. Kraken will have to address these issues as it moves forward with its plans.

The Future of Investing?

This launch by Kraken may herald a future where traditional investments are increasingly digitized, potentially precipitating a broader shift away from conventional stock exchanges. Imagine being able to trade tokens representing thousands of companies from your smartphone with just a few taps, all while enjoying the efficiency and speed of blockchain transactions. Kraken appears committed to making this vision a reality.

What’s Next for Kraken?

In a world where cryptocurrency is gaining traction, Kraken’s foray into tokenized equities represents a significant strategic pivot. The exchange has garnered a reputation for being innovative, but this initiative positions it at the forefront of the financial technology arena. As they prepare to roll out the ability to trade these tokens, investors and analysts alike will be keenly observing how this affects the existing dynamics of stock trading, both in traditional markets and within the crypto landscape.

Conclusion

Kraken’s decision to launch digital tokens for iconic companies like Apple, Tesla, and Nvidia is a bold step towards integrating traditional finance with the growing world of decentralized finance. Its implications reach far beyond just creating a means for trading stocks; they could potentially redefine the very fabric of investing as we know it. As the financial world continues to evolve, Kraken’s innovative approach may indeed set a precedent that other exchanges and platforms will soon follow.

Looking Ahead: What Investors Should Watch For

As Kraken prepares to unveil its tokenized equities platform, investors should keep abreast of regulatory developments, the user experience, and how well the tokens hold up against traditional stock performances. The impact on liquidity in both the equity and crypto markets will be critical, potentially setting the stage for future hybrid trading platforms.

Ultimately, as tokenization further gains traction, it is essential for investors to conduct thorough research and understand the nuances of this new investment vehicle. There are significant advantages to this approach, but with those advantages also come inherent risks, and investors must be prepared to navigate this evolving environment.