Microsoft Stock Price Soars: Analyst Upgrades and AI Potential

Microsoft Corporation (NASDAQ: MSFT) has been in the spotlight lately, and for good reason. The tech giant, which has been a central player in the technology sector for decades, continues to attract attention from investors and analysts alike. Recently, Mizuho Securities made headlines by raising Microsoft’s price target to an ambitious $540, indicating their strong bullish outlook due to the company’s advancements in artificial intelligence (AI).

Understanding the Price Target Increase

Mizuho’s upgrade isn’t just a number; it reflects a sharper focus on AI, which is transforming industries across the globe. The firm reiterated its ‘Outperform’ rating on Microsoft, citing the company’s strategic investments in AI technology as a primary driver behind this increase. According to the analysts, Microsoft’s commitment to AI-driven services and solutions is setting the stage for long-term growth and revenue potential.

The AI Revolution

Diving deeper into the reasons behind Mizuho’s upgrade, it’s crucial to understand the current landscape of AI technology and how Microsoft is positioning itself as a leader. Companies everywhere are integrating AI into their operations, and Microsoft is no exception. With platforms like Azure AI, Microsoft 365, and an array of tools powered by AI, they are consistently enhancing productivity and operational efficiencies for their clients.

Key Innovations

- Azure AI: This cloud computing platform uses AI and machine learning to analyze data, offering businesses deep insights that drive better decision-making.

- Microsoft 365: Incorporating AI-driven features such as predictive text in Word and advanced analytics in Excel, Microsoft 365 provides users a modern and intuitive experience.

- Power Platform: Microsoft’s low-code/no-code approach allows users to create apps and automate workflows, greatly enhancing business agility.

As businesses continue to recognize the value of AI, Microsoft’s portfolio becomes increasingly attractive. This aligns with Mizuho’s projections, which highlight an expected uptick in both demand and usage of AI-driven tools over the coming years.

Should You Buy Microsoft Stock Before July 30?

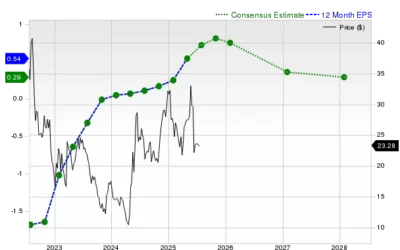

With the stock now riding high on analyst enthusiasm, potential investors are left asking the critical question: Should I buy Microsoft stock before July 30? Although investment decisions should ultimately align with individual financial goals and risk tolerance, an understanding of recent trends and analyst sentiments can offer valuable insights.

Market Trends

As of now, Microsoft’s stock has performed exceptionally well in the face of a volatile market, driven largely by positive earnings reports and forward-looking analyses that anticipate strong growth due to AI contributions. Moreover, Microsoft’s recent initiatives to integrate ChatGPT and other cutting-edge AI technologies into its products serve to further enhance user value and engagement.

Balancing Risks

However, it’s essential to consider the inherent risks involved. The tech sector can be highly competitive and subject to rapid changes in shareholder sentiment. Additionally, broader economic factors, such as inflation rates and interest hikes, could place pressure on tech stocks, potentially impacting performance in the near term.

5 Big Analyst AI Moves This Week

In addition to Mizuho’s upgrade for Microsoft, this week has seen noteworthy moves from high-profile analysts regarding other companies in the tech sector, particularly those heavily invested in AI.

Other Significant Upgrades

- Tesla (TSLA): Analysts predict that Tesla’s focus on AI for autonomous driving will propel its price forward, anticipating a rise as the EV market continues to innovate.

- Intel (INTC): With increasing interest in AI hardware capabilities, Intel’s latest products may allow them to reclaim market share, leading analysts to upgrade their ratings.

- Alphabet (GOOGL): As Google expands its AI offerings, the stock sees a positive outlook, especially concerning cloud service growth.

These adjustments signify growing investor confidence in AI’s potential. As AI becomes more integrated into business operations, firms that are positioned to lead in this technology—like Microsoft, Tesla, Intel, and Alphabet—will likely see robust demand for their stocks.

Conclusion

Microsoft’s recent price target upgrade by Mizuho highlights the company’s dominance in the tech sector, particularly in AI advancements. For existing shareholders and potential investors, the key takeaway should be the strength of Microsoft’s strategy and its focus on building AI-driven applications and services that cater to evolving market needs.

However, it is crucial to evaluate personal financial circumstances and market conditions before making investment decisions, especially as we approach the critical date of July 30. As with any investment, consider conducting further research and consulting with financial advisors to navigate the complexities of the stock market effectively.

Disclaimer: The opinions expressed in this article are for informational purposes only and do not constitute financial advice. Always conduct your own research before making investment decisions.