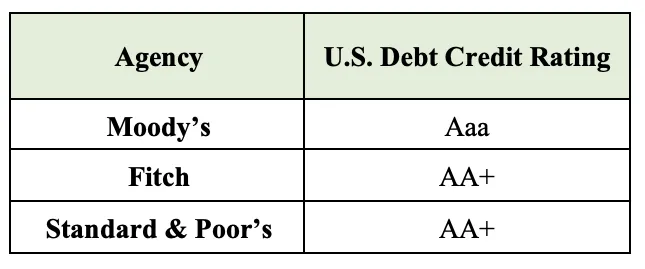

Moody’s Downgrades United States Credit Rating: A Shift in Financial Stability

On [Date], Moody’s Investors Service announced a significant downgrade of the United States’ credit rating from its coveted ‘AAA’ status to ‘Aa1’. This shift comes as a response to escalating government debt levels, which have raised serious concerns among investors, economists, and policymakers alike.

The Implications of the Downgrade

The downgrade signifies more than just a change in rating: it serves as an indicator of potential changes in the economic landscape. The ‘AAA’ rating has been a hallmark of U.S. financial stability, regarded globally as a safe benchmark for investments. The move to ‘Aa1’ suggests that while the creditworthiness of the U.S. remains strong, there are clouds gathering on the horizon that investors cannot ignore.

Debt Levels: The Underlying Issue

According to Moody’s, the primary driver for the rating drop stems from the increasing government debt burden. Currently, national debt is at an all-time high, surpassing $31 trillion, and projections suggest that debt will only continue to climb in upcoming years. This unease mirrors concerns raised by various credit rating agencies, which have been warning about the sustainability of U.S. fiscal policy.

Understanding the Ratings: What Does ‘Aa1’ Mean?

The ‘Aa1’ rating still indicates a high level of creditworthiness, but it does reflect diminishing confidence in the government’s ability to manage fiscal policy effectively. Those in possession of government bonds may experience increased volatility, as the rating can influence interest rates and borrowing costs.

The Effects on Borrowing Costs

As the downgrade works its way through financial markets, investors may demand higher yields on U.S. Treasury bonds, which could lead to increased borrowing costs for both consumers and businesses. Higher interest rates could see mortgage, auto loan, and credit card rates spike, affecting everyday Americans.

A Ripple Effect on the Global Economy

The ramifications of the U.S. credit ratings downgrade extend beyond American shores. Since the U.S. dollar serves as the world’s reserve currency, a shift in the perceived reliability of U.S. credit can reverberate throughout the global economy. Countries and investors that rely heavily on U.S. financial instruments may face daunting decisions regarding their exposure.

Investor Sentiment

Investor sentiment may take a hit, particularly among risk-averse individuals who prioritize safety over potential returns. The ‘Aa1’ rating may deter some investors while prompting others to shuffle their portfolios and pursue alternative assets, such as gold or cryptocurrencies, signaling a cautious approach to U.S. investments.

Political Implications of the Downgrade

Beyond economic factors, the downgrade raises questions regarding political stability and governance. Moody’s cited the government’s standoff over the debt ceiling as a critical element influencing its decision. Continuous budgetary gridlock and perceived inability to address fiscal issues can hinder investor confidence, amplifying fears of future downgrades.

The Role of Policy Makers

Moving forward, government action will be paramount in addressing the challenges highlighted by Moody’s. Policymakers will face intense pressure to demonstrate their commitment to fiscal responsibility while also implementing measures to stimulate economic growth. The balance between investing in infrastructure and managing debt will be a pivotal conversation in Congress.

Historical Context: U.S. Credit Ratings Over Time

The United States has not faced a credit rating downgrade since 2011 when Standard & Poor’s downgraded its credit rating from ‘AAA’ to ‘AA+’. At the time, issues surrounding the debt ceiling and inability to reach bipartisan agreements played a significant role. Reverting to a lower rating, coupled with the ongoing economic challenges exacerbated by the COVID-19 pandemic, creates a sense of urgency for effective policymaking.

Comparison with Other Nations

In comparison, the downgrade may align the U.S. with other Western economies currently facing financial strains, thereby affecting not just the U.S., but the entire global financial system. Credit ratings of countries like France, the UK, or Japan may warrant closer scrutiny as investors reevaluate risk.

What Lies Ahead

The new rating comes at a critical juncture as the U.S. attempts to stabilize its economy amid numerous external pressures, including inflation rates, geopolitical tensions, and supply chain issues. Monitoring the government’s response to these challenges will be crucial in shaping U.S. credibility moving forward.

The Path to Recovery

Restoring confidence may involve comprehensive strategies, such as comprehensive tax reforms, targeted spending cuts, and enhanced revenue generation methods. The conversation surrounding government debt and fiscal responsibility is poised to take center stage, not only in political discourse but as a pressing necessity for future economic stability.

Conclusion: A Wake-Up Call

Moody’s recent downgrade serves as a wake-up call for the United States, highlighting the urgency for a rational dialogue regarding fiscal responsibility and the management of government debts. As citizens and investors watch closely, the ability of policymakers to restore confidence and take decisive action will ultimately determine the future of the U.S. economy and its standing in the international financial community.

In the coming days and months, the spotlight will shine bright on Congress, the administration, and policymakers as they navigate a course that leads back towards fiscal stability. The outcome will not only impact the country but will also resonate across the globe—a testament to the interconnectedness of modern economies.