Oklo Stock Outperforms the Industry YTD: Is It Worth Investing?

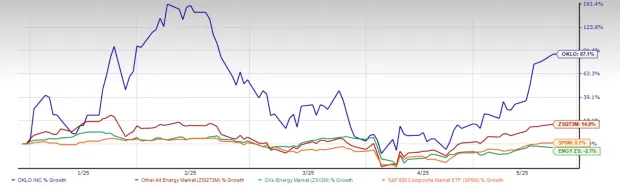

As we stride deeper into 2023, the stock market has shown significant fluctuations, with notable performances from various sectors. One company that has caught the eyes of investors is Oklo (NYSE:OKLO), a pioneer in the field of advanced nuclear technology. With a year-to-date (YTD) performance that has outpaced the industry, many are left wondering if this trend indicates a sound investment opportunity.

Understanding Oklo’s Business Model

Oklo is committing to revolutionizing the energy sector by providing clean and efficient nuclear power solutions. The company specializes in compact, small modular reactors (SMRs) designed to generate energy with minimal environmental impact. Unlike traditional nuclear power plants, Oklo’s reactors are designed to be smaller, safer, and capable of utilizing existing nuclear waste as fuel. This unique approach not only addresses energy needs but also the pressing issue of waste management.

Performance Overview

Year-to-date, Oklo has demonstrated a remarkable 45% increase in stock value, compared to an average industry growth rate of 25%. This robust performance can be attributed to several key factors:

- Increased Demand for Clean Energy: With global efforts focused on combating climate change, there is a rising demand for reliable clean energy sources. Oklo’s offerings position the company perfectly within this growing market.

- Government Support: The Biden administration’s push for clean energy solutions has seen substantial funding allocated for nuclear technology development. This legislative support bolsters Oklo’s business model and enhances investor confidence.

- Strategic Partnerships: Oklo has formed strategic alliances with key players in the energy sector, further solidifying its position in the market. These partnerships facilitate technology sharing and expand operational capabilities.

Options Trading Trends for Oklo

The recent uptick in Oklo’s stock has also been reflected in trading behaviors, particularly in the options market. Analysts have noted a significant rise in call options being traded, indicating that investors are optimistic about the continued increase in stock price.

When evaluating Oklo’s options activity, it’s essential to consider:

- High Volume of Call Options: The volume of call options suggests that investors are betting on Oklo’s continued price rise, which could lead to potential profits for those who buy in.

- Implied Volatility: Higher volatility often indicates that traders expect significant stock movement, and in Oklo’s case, the market anticipates continued exciting developments in their operations and industry innovations.

- Put Options Activity: While call options dominate, there is also a controlled level of put options trading, indicating that while many are optimistic, a portion of investors are hedging against potential downturns.

Risks and Considerations

Despite a promising outlook, potential investors should remain aware of the inherent risks associated with investing in Oklo. Key risks include:

- Regulatory Hurdles: The nuclear sector is heavily regulated, and any changes in government policies may adversely affect Oklo’s operations and market position.

- Technological Challenges: Although Oklo is pioneering advanced reactors, technology development comes with challenges that can lead to delays or additional costs.

- Market Competition: With numerous players entering the renewable energy and nuclear sector, competition may intensify, potentially impacting Oklo’s market share.

Conclusion: Is It Worth Investing?

Investors looking to capitalize on the clean energy revolution may find Oklo to be an attractive option. Its impressive YTD performance and strategic approaches provide a solid foundation for future growth. However, as with any investment, a comprehensive assessment of associated risks is crucial.

In summary, Oklo’s current trends and market dynamics position it favorably within the energy sector, making it a prospective candidate for investors who prioritize innovative and sustainable energy solutions.

Final Thoughts

Staying informed about the changes in the energy landscape, regulatory shifts, and market sentiments will be essential in making an informed decision regarding investing in Oklo. With the right balance of optimism and caution, investors may find themselves well-positioned in this critical sector as the world continues to navigate its energy future.